Commercial and corporate banking hiring was stable in 2017 in line with the slowly recovering economy. Most employers want to meet as many candidates as possible and conduct their own reference checks. In the coming year, several banks are expected to establish new teams to cover the Pearl River Delta region creating solid demand for candidates with relevant geographical experience.

We also expect strong FinTech activity in corporate banking that will create high demand for candidates with cash management experience. Although trade finance and loans remains a large portion of the bank’s operations, demand for cash solutions talent will continue to increase.

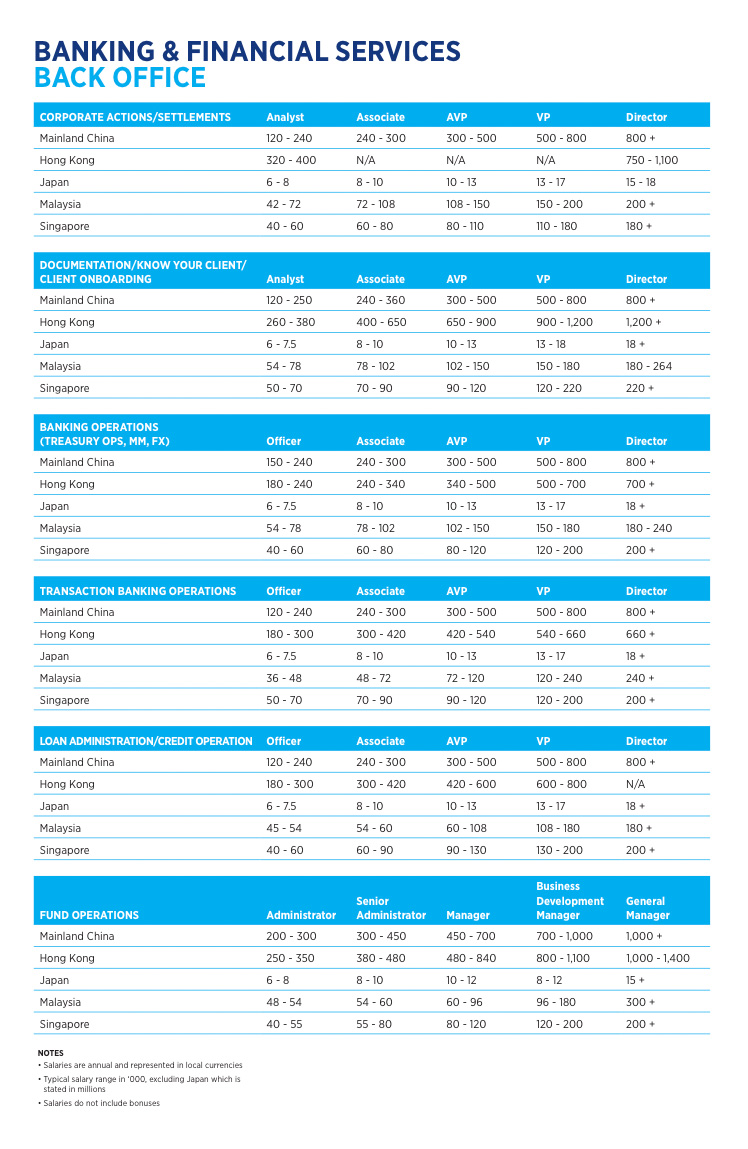

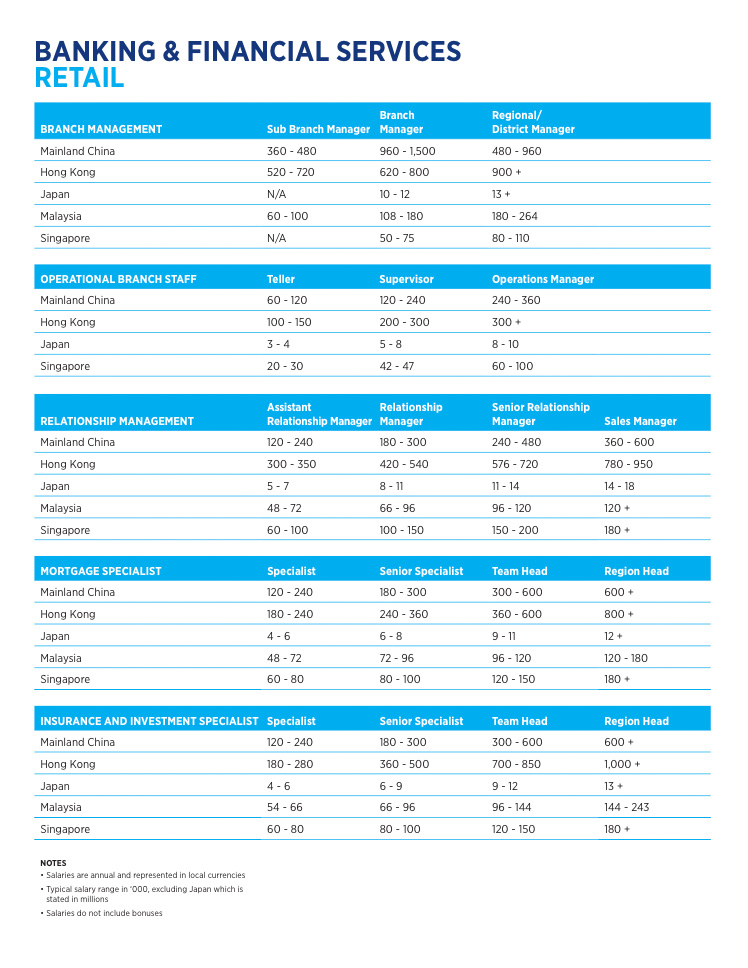

In the private banking sector, greater client acquisition for European financial institutions, including Swiss institutions, is generating strong hiring demand for quality Relationship Managers. Compliance, risk and control recruitment will also be healthy in 2018. Likewise, demand will be high for talent to fill know

your customer (KYC) and client onboarding roles with many of them to be offered short-term contracts.

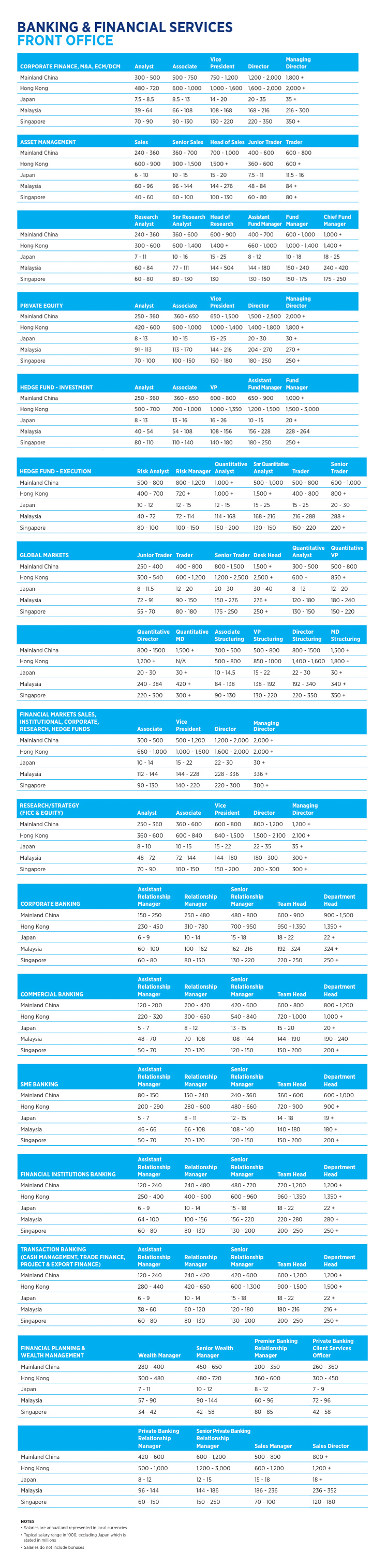

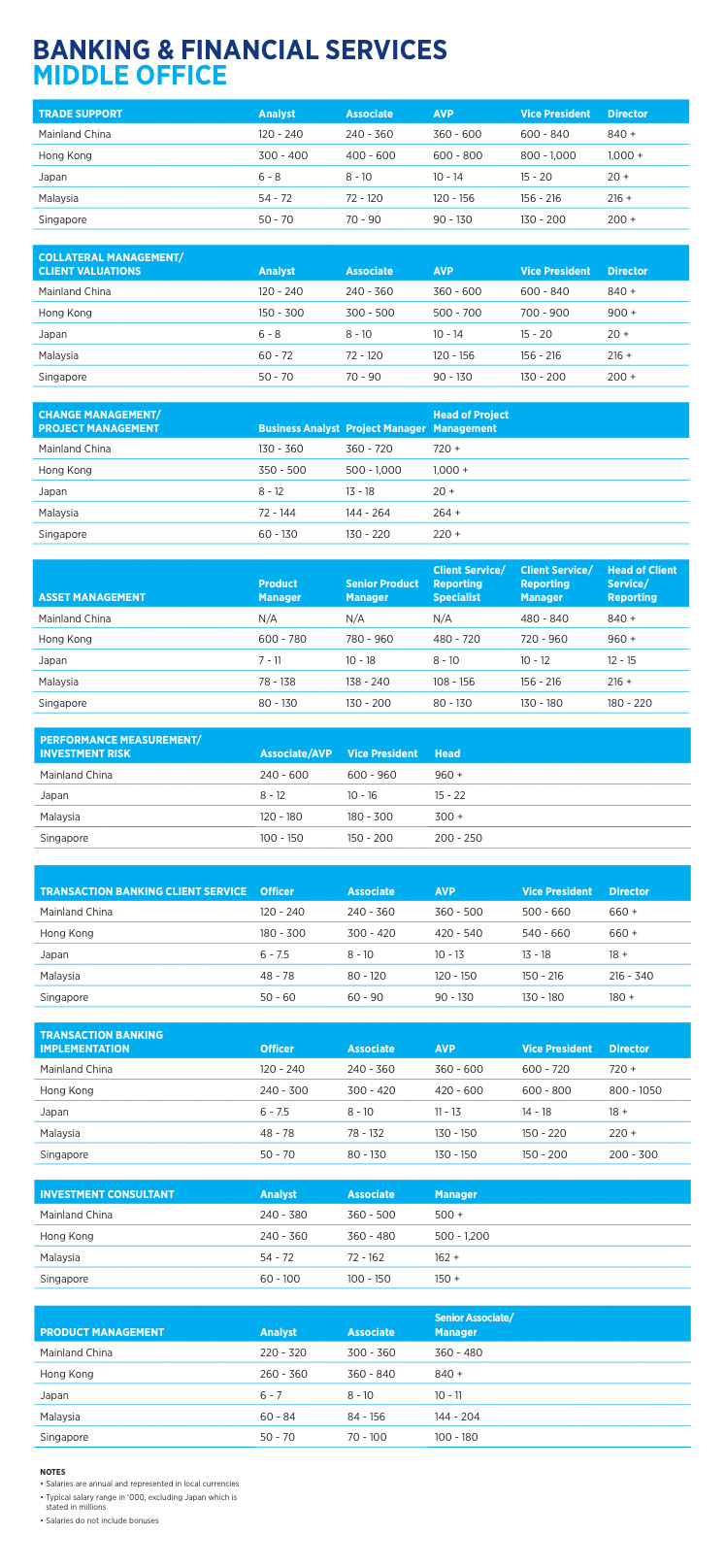

The shift from front office roles to middle office roles will continue at the same pace, but candidates for both new and replacement roles will face greater scrutiny during recruitment selection processes in 2018. We advise candidates to manage their salary expectations carefully and know their true push/pull factors when considering a switch of jobs in 2018.

Source:Hays Salary Guide 2018