Critical illness coverage is one of the most significant medical benefits wanted by employees, yet less than 10 per cent of employers offer such protection as part of their employee benefits (EB) schemes, according to a recent survey commissioned by the AIA Group.

The survey, based on interviews with 821 employees and senior managers at 413 companies in Hong Kong, Malaysia, Singapore and Thailand, found that the financial hit of being unable to work in the event of serious illness was employees’ second biggest concern. Their top concern – cited by four out of five employees – was the rising cost of medical care.

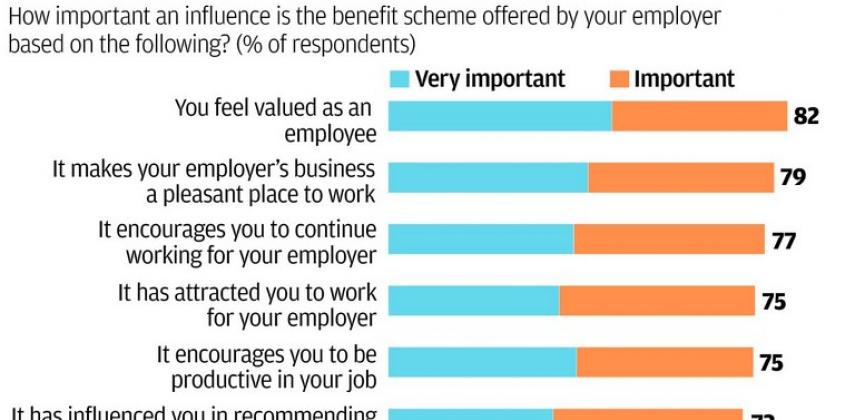

The findings underscore the importance of EB schemes. A total of 82 per cent of employees said that the schemes make them feel valued, and 77 per cent claimed that the protection encourages them to continue to work for their employer. Three out of four respondents claimed that EB schemes help them to be productive in their job. From the employers’ perspective, almost 8 out of 10 said that group insurance is important in attracting and retaining high-calibre employees

Employers who held back on critical illness coverage – which pays out a lump-sum amount if an employee experiences a life-threatening condition such as cancer, heart attack, stroke or kidney failure – saw cost as the most significant constraint. On average, they thought it would add 38 per cent to their premium costs.

However, Ben Ng, CEO of group corporate solutions at the AIA Group, says that employers often think that critical illness coverage will cost more than it really does. “Employers think highly of EB schemes as an incentive to attract and retain talent, but they over-estimate the actual cost implication of this coverage,” he says.

In the survey, 73 per cent of employers expressed greater willingness to provide critical illness coverage to their employees after being told that, in reality, it would result in less than a 10 per cent rise in overall premiums.

Martin Cerullo, Asia-Pacific managing director of development at Alexander Mann Solutions, a talent acquisition and management services provider, believes critical illness cover can help employers stand out in the job market.

“In certain countries such as the Philippines, where we are growing rapidly, we are seeing more inquiries for critical illness to be added to our medical benefit policies where this cover is not provided by the state,” Cerullo says. “Where this is the case, this is absolutely seen as an attractive differentiator in specific countries for candidates and we bring this to life throughout the recruitment process.”

He adds, too, that it is usually the cost of cover that makes companies choose to not offer critical illness coverage.

Ng says that employers that have witnessed the debilitating financial consequences of critical illnesses are more likely to take out critical illness cover for their employees. Over half of the surveyed employers (53 per cent) have had at least one employee unable to work because of a critical illness, while 13 per cent have experienced multiple cases.

In order to stay within budget constraints, Ng advises employers to restructure their EB schemes to provide a mix of benefits – including critical illness cover – while keeping cost increases to a minimum.

“The insurance industry has lots of work to do in terms of creating awareness, educating the HR community and training our advisers to address this need,” Ng says.

Many of the companies that offer critical illness cover are technology firms and financial institutions which offer flexible benefit schemes. Under such plans, employees receive basic medical cover, plus an additional amount that they can choose to use either to upgrade their medical insurance, or to buy life insurance or critical illness cover.

“Though employers provide group medical cover, most of the time it doesn’t cover 100 per cent of the medical bills,” Ng says. “Our experience is that it could potentially cover only 70 per cent of the hospital bills. This lump-sum payment from the critical illness cover can be used for income loss or cover excess medical expenses.”

Ng expects more employers to offer critical illness cover in the coming five years, with SMEs leading the way forwards. “The SME segment has a faster adoption rate, as these employers have simpler decision-making processes,” he says.

Career Advice

Job Market Trend Report

Select article category

Select article category

Career Advice Home

Personal Development and Career path

- Career Doctor

- Career Guidance and Counselling

- English for professional use

- How to Get Promoted

- Job seek in HK

- Plan and start the career path

- Tips to be more productive

- 職場英語 專家教路

How to successed in industry

- Banking and Finance

- Education and Training

- Government and NGO

- Property and Construction

- Startup

Industry Stories, recruitment tips and case study

- Featured stories and job trends

- Legal Case studies for employers

- Recruitment tips

- Successful entrepreneurs’ story

- Successful High flyers’ story

- 職業特搜

Job Market Report, fair and events

- Job fairs and Events

- Job Market Report

- Job Market Trend Report

Select article category

-

Select article category

- Career Doctor

- Career Guidance and Counselling

- English for professional use

- How to Get Promoted

- Job seek in HK

- Plan and start the career path

- Tips to be more productive

- 職場英語 專家教路

Career Advice Home

Personal Development and Career path

- Banking and Finance

- Education and Training

- Government and NGO

- Property and Construction

- Startup

How to successed in industry

- Featured stories and job trends

- Legal Case studies for employers

- Recruitment tips

- Successful entrepreneurs’ story

- Successful High flyers’ story

- 職業特搜

Industry Stories, recruitment tips and case study

- Job fairs and Events

- Job Market Report

- Job Market Trend Report

Job Market Report, fair and events

Employers flat-lining on critical illness cover

Medical

,

AIA Group

,

Insurance

,

Employee Insurance

,

employee benefits

,

Malaysia

,

Singapore

,

Thailand

,

Alexander Mann Solutions

,

Philippines

,

Technology

,

Financial Institutions

,

SMEs

,

Human Resources

,

Critical Illness

Other Related Articles

Recommended jobs for you

- Job Posting Enquiry

- + 852 3619 9601 (M-F, 9am - 6pm)

- advertise@cpjobs.com

- General Enquiry

- + 852 3619 9600 (M-F, 9am - 6pm)

- info@cpjobs.com

- Partner with: Classified Post

- + 852 2565 8822 (M-F, 9am - 6pm)

- classified@scmp.com

Copyright © 2025. CPJobs International Limited. All rights reserved

Employment Agency Licence No. 76396