At the top of every company is the board, the decision-making brain of the organisation. While the structure may vary slightly between countries and cultures, a board ultimately consists of a group of appointed or elected members who oversee the activities of a company.

Collectively, these top-tier teams of directors and executives govern and supervise the company, managing financial decisions such as budgets and salaries, as well as closely monitoring performance, risk and corporate governance.

However, recent data from Heidrick & Struggles indicates Asia-Pacific boards may need to change the way they run their companies. The firm’s Asia-Pacific Corporate Governance Report for 2014 has found that companies are placing too much emphasis on compliance at the expense of corporate strategy.

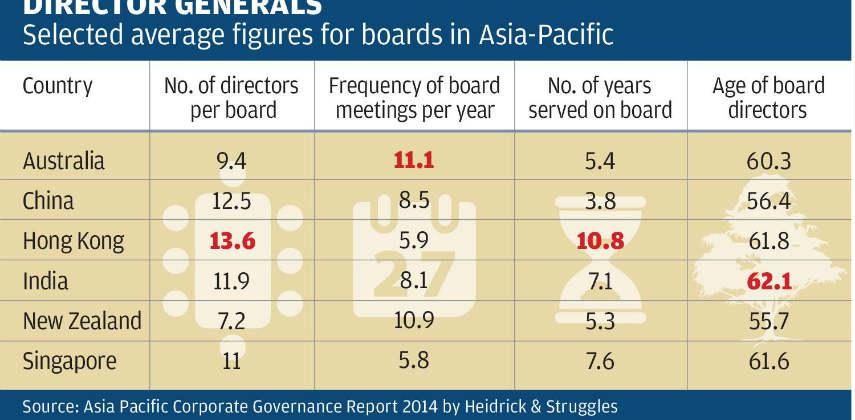

The data was compiled from 170 publicly listed companies n India, China, Hong Kong, Singapore, Australia and New Zealand, with more than 165 board members surveyed.

“With increasingly stringent new legal compliance rules and stock exchange guidelines, board meetings nowadays tend to focus heavily on compliance issues,” says Harry O’Neill, managing partner for Asia-Pacific at Heidrick & Struggles. “However, a forward-thinking board should be able to assess the resilience of a business, as well as its ability to innovate, while understanding the risks involved in innovation.”

David Pumphrey, partner at Heidrick & Struggles, says these new laws and guidelines have become increasingly firmer in Hong Kong, in particular since 2012. “Regulators in Hong Kong are bringing in corporate governance which they want to make law, and they are pushing to formalise this in a stronger sense. Boards will have to change quite significantly over the next five years. [Companies] will need their boards developed in new skills, diversity and most importantly, independence.”

Corporate governance has been a major issue over the past decade or so, with stock market troubles running rife and a number of high-profile corporations having collapsed.

While there have been significant improvements across the Asia-Pacific region in recent years with regard to compliance performance, regulators are still pushing strongly for stronger measures, particularly in Hong Kong where the survey reported that local boards were not as prone to engaging external advisory parties to review their boards’ effectiveness.

Hong Kong boards will need a makeover for other reasons as well. They have the lowest percentage of non-executive directors in Asia-Pacific (66 per cent), but the highest average number of directors per board (13.6).

The study also found that firms in the city need a greater mix of non-national directors on their boards. This is part of a general lack of momentum in increasing diversity in nationality and gender.

“In Hong Kong, the international representation is nowhere near as great as it needs to be to satisfy the global nature of a company in those countries,” Pumphrey says, adding that there should be a broader spread of directors on these boards since multinational companies are becoming more commonplace.

Meanwhile, Hong Kong has the highest average tenure of board members in the region, at 10.8 years, indicating that succession planning is a key issue.

Marcus Moufarrige, chief operating officer at serviced office specialists Servcorp, says there is a thin line between age and experience.

“While experience certainly helps when trying to identify the things that could sidetrack your vision, sometimes splendid naivety creates the opportunity for innovation and vision. My view is that board age should range from 40 to 70. A good mix of youthful exuberance, vision and knowledge is a good thing,” he says.

Regardless of age or regulations, ultimately, a high-performing board is all about the people and the way they work together. Regular reviews should be made of directors and good communication is key. Without a common culture and a strong bond between directors, boards will be compliance-driven, and ineffective.

“Only when everyone is aligned and engaged on the vision can a strategy be developed,” Pumphrey says.